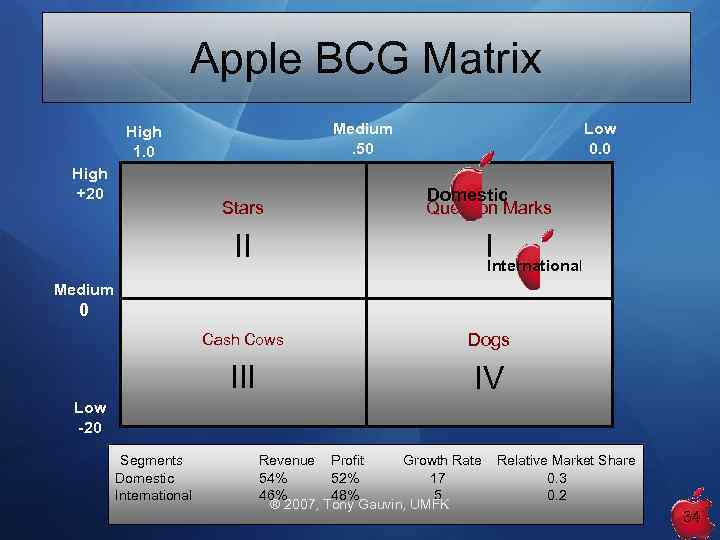

These business units have a low market share because of high costs, poor quality, ineffective marketing, etc. It can easily be understood that these business units do not generate case and they do not require huge investment to maintain as they operate in a low growth industry. Dogsĭogs are the business units having low market share in a low growing market. Cash cows are placed in the lower left quadrant of the matrix. These are the core business units which are the main source of revenue for the company and these units provide the stability to the company. Cash cows are profitable business units which require little investment to maintain them and the profit generated from these businesses can be utilized for investment in other business units of the company. How to Make Appropriate Strategy Using BCG Matrix?Ĭash cows represent the business units having a large market share in a mature, slow moving industry.Apple's Macs could be considered in the dog category as Apple is not a market leader in this market segment as there competitors have the desktop market in a monopoly. Hard drive based iPods peaked a while ago as well and there are just so may competitors that can create a simple product such as an i pod now. They make a lot of them, but computing is quickly shifting to portable and mobile so they are also in the dog section.ĭogs- The big multi-part desktop is fading away. The all-in-one i Mac is in that cash cow place.

These products are so successful that their growth potential is really unknown.Ĭash Cows-The Mac Books are the portables of choice right now.

Rising Star -The iPhone and i Pad are rising stars. There are tons of rumors of an Apple TV product that might just maybe dominate like the iPod/iPhone/i Pad If Apple can solve a few ecosystem problems, they could really own the TV space. Question Mark- Apple TV makes a bit of money, but it’s not reaching it’s potential.

0 kommentar(er)

0 kommentar(er)